Table Of Content

Living in Baldwin Park, you’ll be close to The Original In-N-Out Burger Museum, a Southern California staple. This suburb is also home to a variety of parks such as Walnut Creek Nature Park and Morgan Park which offer grassy areas perfect for a sunny picnic. Whether you’re currently buying a home in Southern California or looking to make the move to the West Coast, check out 10 of the best affordable suburbs within driving distance of Los Angeles. That way you don’t have to miss out on weekend visits to the Los Angeles County Museum of Art (LACMA) or watching a Los Angeles Lakers game at your favorite bar. The typical repeat buyer puts down 19%, while new buyers put down 8%.

Fun Facts About San Marcos, CA How Well Do You Know Your City?

Homeowners insurance should not be confused with private mortgage insurance, which is something else entirely. Monterey Park takes the final spot on our list of affordable Los Angeles suburbs you’ll want to consider moving to. Without traffic, you’ll find yourself in Los Angeles in roughly 15 minutes. This suburb has a population of roughly 61,100, making it a mere fraction of Los Angeles’ population.

Title insurance

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Likely rate: 7.422% Edit rate

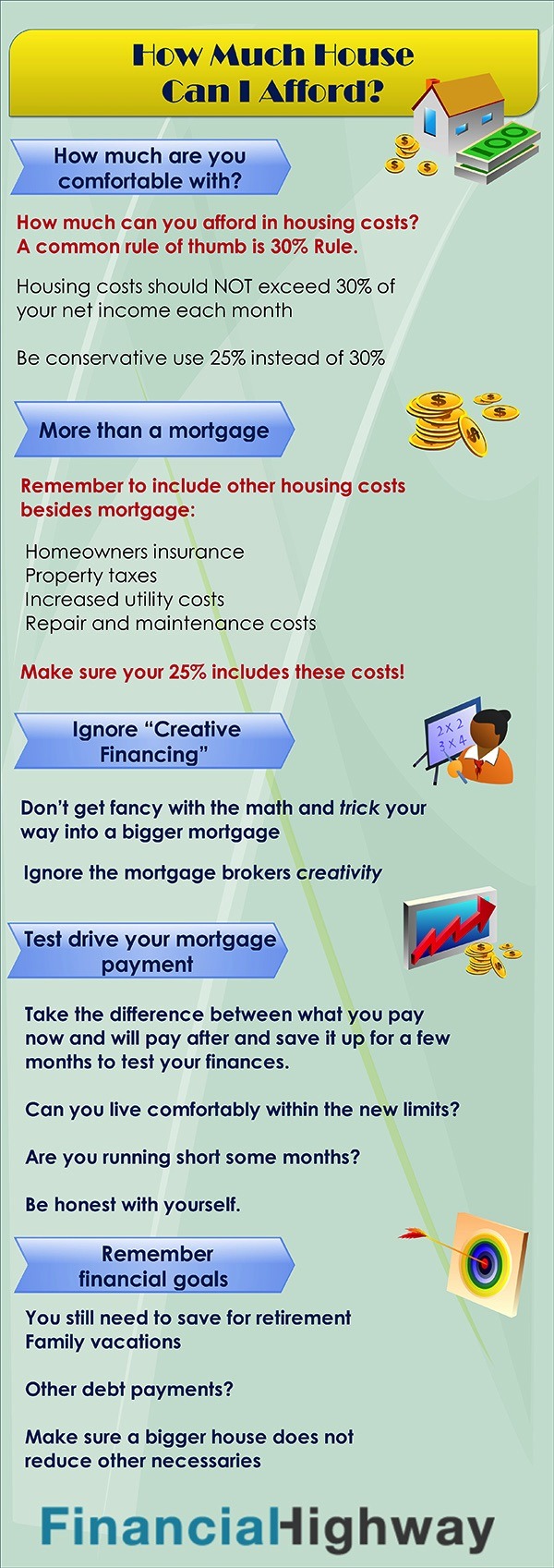

You can also check out current mortgage rates in your area for an idea of what the market looks like. Naturally, the lower your interest rate, the lower your monthly payment will be. Want a quick way to determine how much house you can afford on a $40,000 household income?

Home affordability FAQs

Evaluate your full financial situation, your ability to pay off a mortgage and where you need to save for other expenditures. Once you’ve done all that, it’s time to go after that perfect home. All three government-backed loans have mortgage limits, which is a handy way to help you stay in a healthy debt-budget range.

Assessing how much you should spend on a house requires a bit of a look into your current and potentially future financial situation. Before you take on the maximum loan you can get and start looking at more expensive houses, consider these tips. They don’t know how much you spend on groceries, child care, entertainment or travel. They don’t know if you’re planning to quit your job and start a business that might make your income irregular.

Conforming loans vs non-conforming loans

As an alternative, you’ll have money for renovations and upgrades. A little work can transform a home into your dream house — without breaking the bank. If you are spending 40% or more of your pre-tax income on pre-existing obligations, a relatively minor shift in your income or expenses could wreak havoc on your budget.

The city itself is sprawling, covering approximately 469 square miles. It's known for its Mediterranean climate, offering residents sunny days most of the year, mild winters, and warm summers. This weather allows for a variety of outdoor activities, from surfing at Venice Beach to hiking in the Santa Monica Mountains.

Although higher housing expenses and DTIs are allowed under many loan types (including conventional, FHA, USDA and VA loans), the 29/41 rule provides a good starting point. You need to calculate how much house you can afford while considering a wide range of loan options. If your mortgage loan is backed by the Federal Housing Administration (FHA), you’ll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums. The calculator doesn’t display your debt-to-income (DTI) ratio, but lenders care a lot about this number. They don’t want you to be overextended and unable to make your mortgage payments.

Nearly half of house hunters don't think they can afford a home — these 4 tips can make it possible - CNBC

Nearly half of house hunters don't think they can afford a home — these 4 tips can make it possible.

Posted: Wed, 17 Apr 2024 07:00:00 GMT [source]

Bankrate’s mortgage calculator can help you explore how different purchase prices, interest rates and minimum down payment amounts impact your monthly payments. And don’t forget to think about the potential for mortgage insurance premiums to impact your budget. If you make a down payment of less than 20 percent on a conventional loan, you’ll need to pay for private mortgage insurance, or PMI.

” What a bank (or other lender) is willing to lend you is definitely important to know as you begin house hunting. You have to make the mortgage payments each month and live on the remainder of your income. Having some money in the bank after you buy is a great way to help ensure that you’re not in danger of default and foreclosure.

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

No comments:

Post a Comment